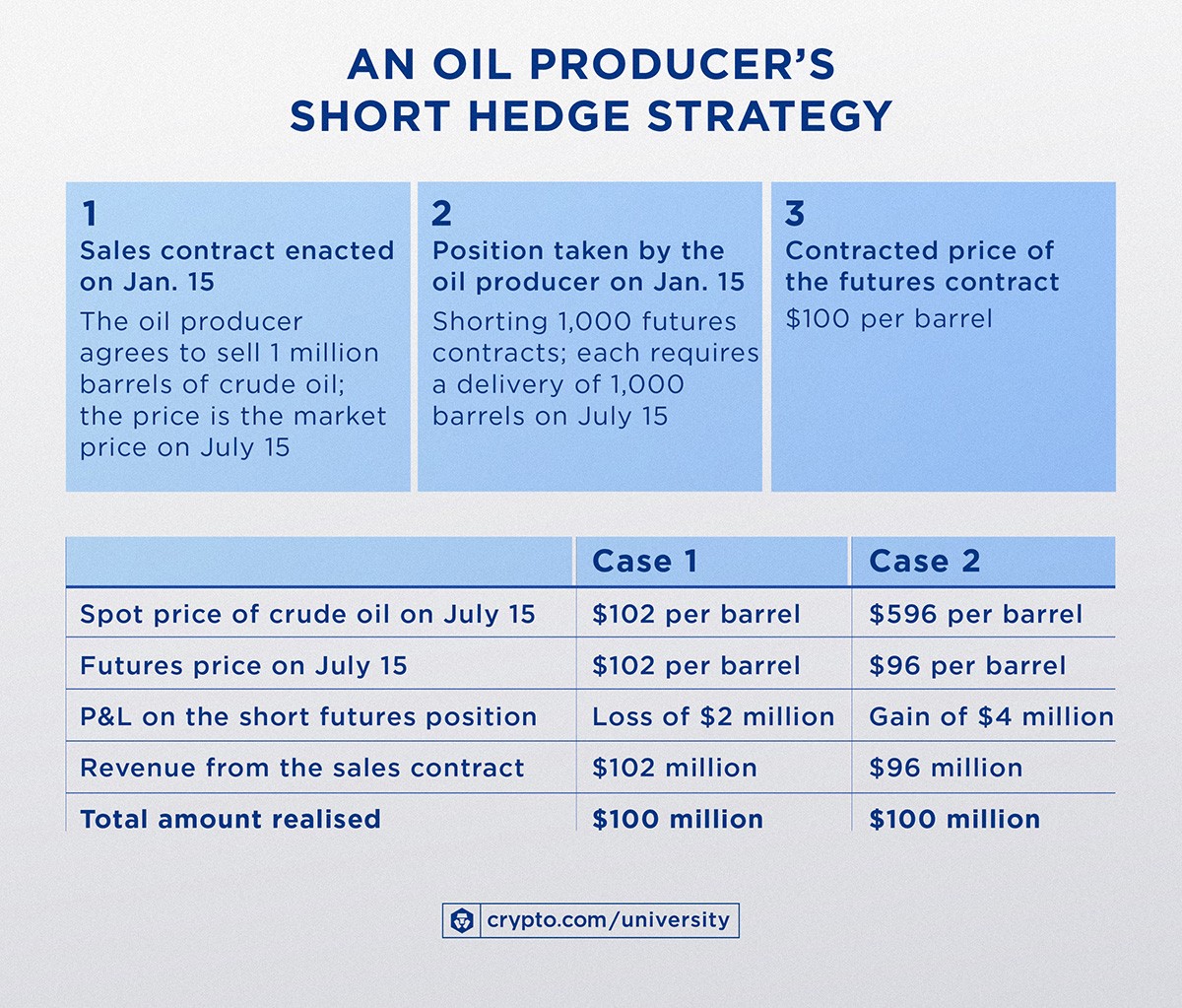

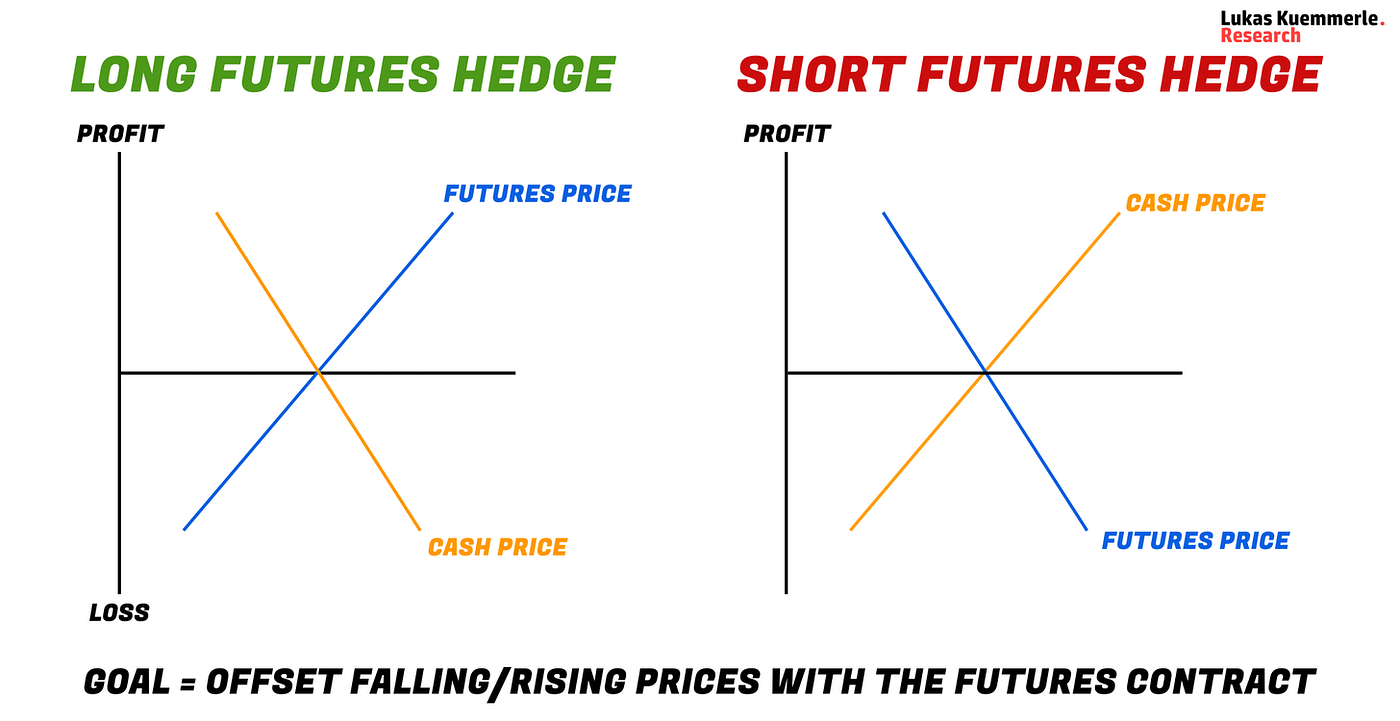

How Commodity Hedging Works. A simple explainer about commodity… | by Lukas Kuemmerle | InsiderFinance Wire

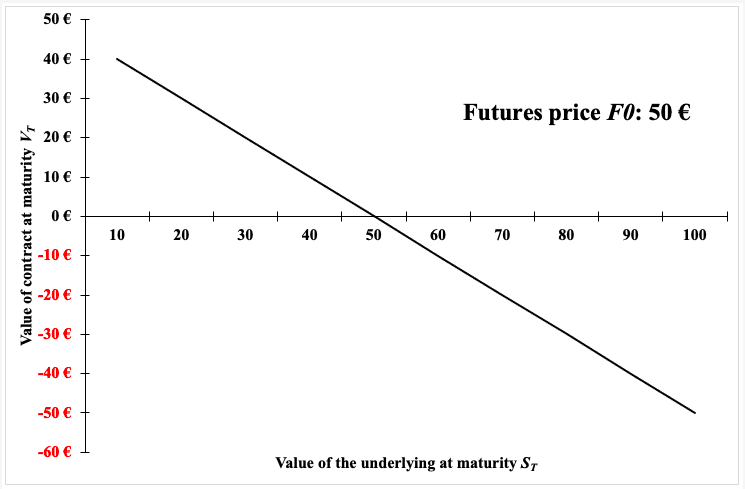

Payoff profile for a futures contract. K and K' are the levels where... | Download Scientific Diagram

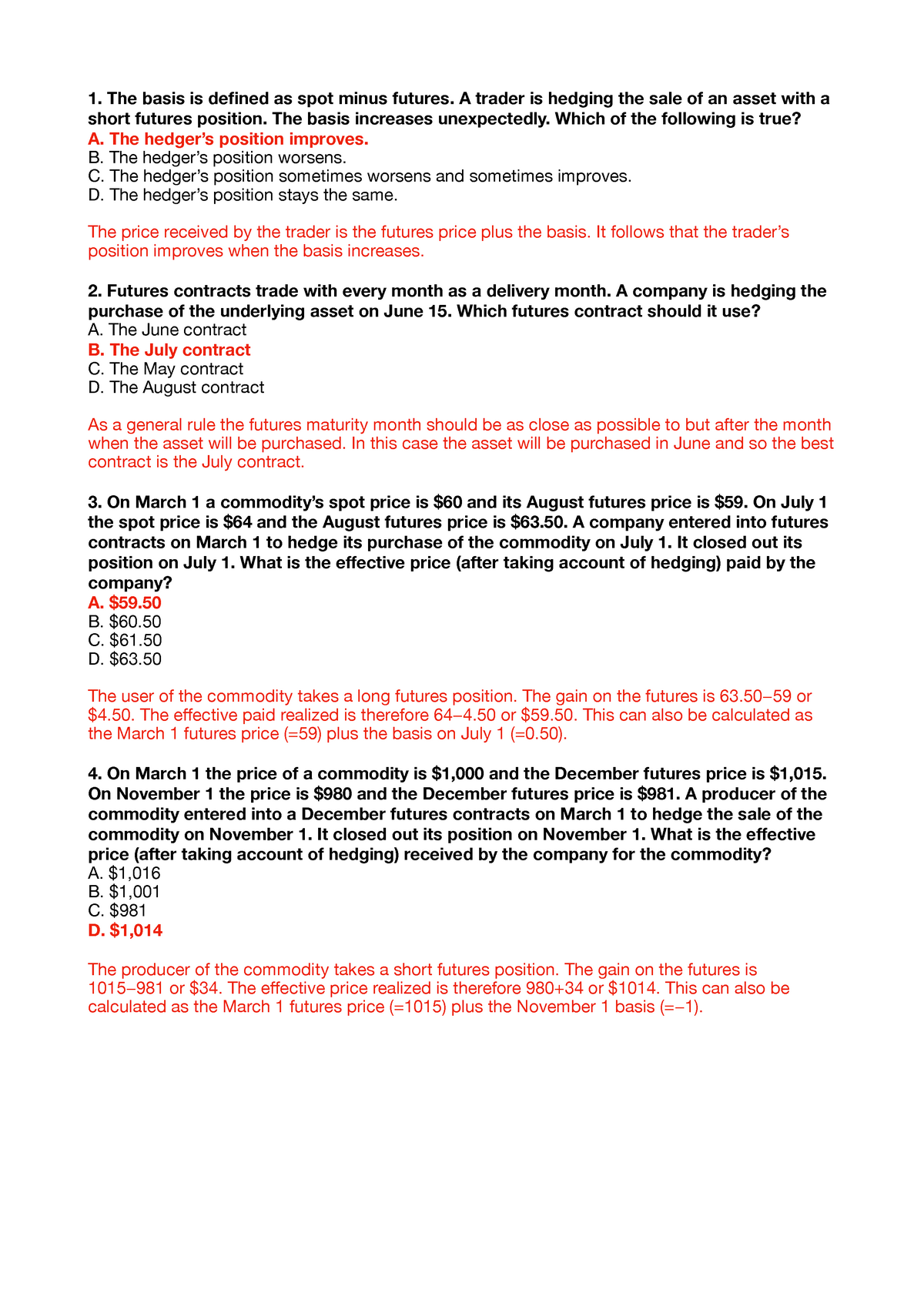

MCQ4 - Tutorial Q+A - 1. The basis is defined as spot minus futures. A trader is hedging the sale of - Studocu